The art market in 2025 finds itself navigating a mix of financial recovery, and shifting collector priorities. Following a challenging 2024, where November auctions in New York saw a 40% drop in sales year-over-year, the market is recalibrating amid broader economic uncertainty and evolving buyer behavior. Despite this, resilience is evident in areas such as blue-chip art, emerging markets, and the rise of private sales.

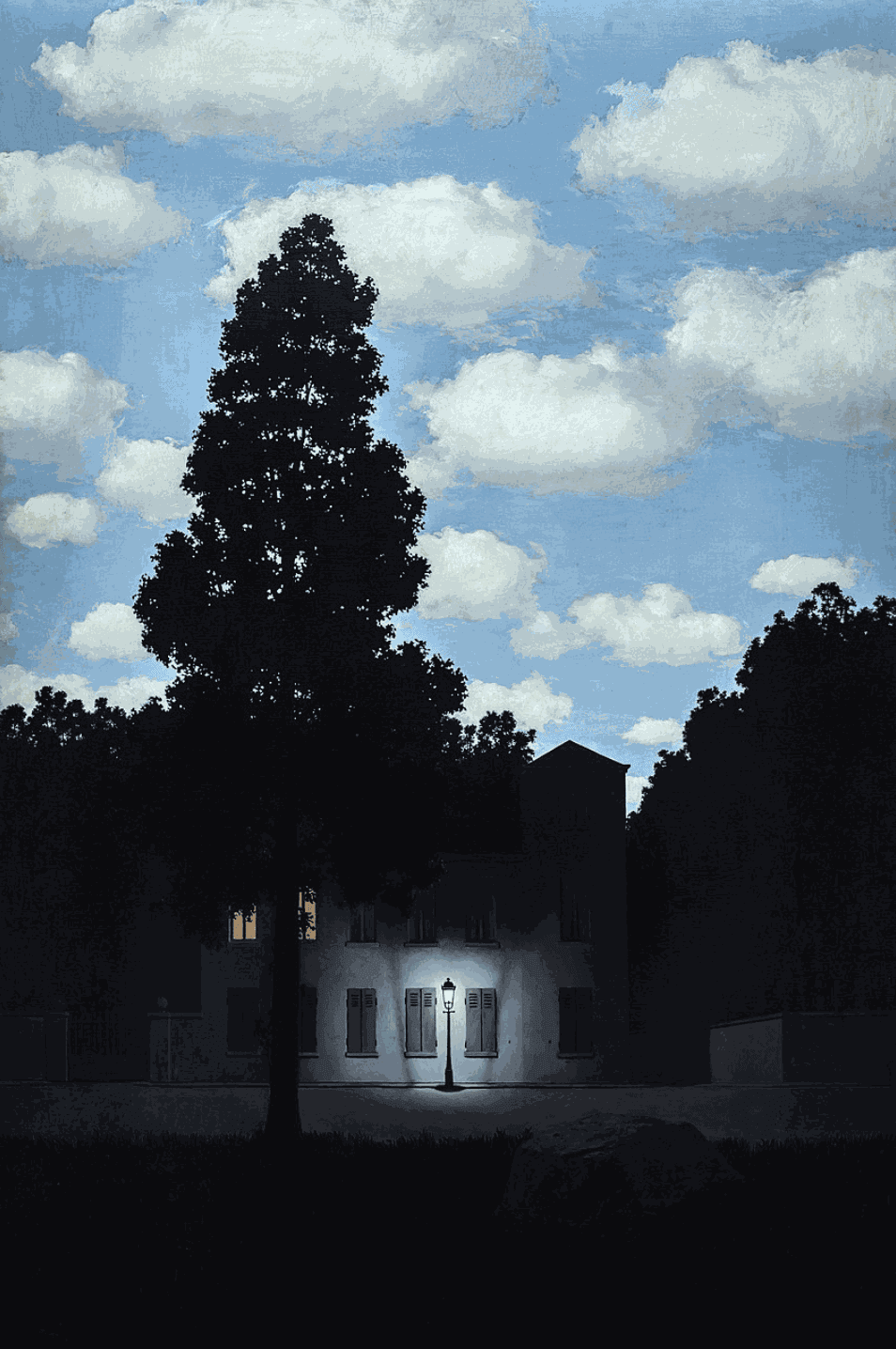

Blue-chip masterpieces continue to dominate the high end, exemplified by René Magritte’s Empire of Light selling for $121.2 million at Christie’s, an auction contrasted sharply with the overall market’s subdued performance. Similarly, Monet’s Water Lilies fetched $65.5 million in November, underscoring collectors’ preference for stability and historical significance over speculative investments. At the same time, ultracontemporary art struggled, with Sotheby’s The Now sale generating just $16.5 million compared to $72.9 million in 2022.

Despite this, private sales have emerged as a vital section of the market. Christie’s reported a 41% increase in private transactions in 2024 with smaller-scale sales under $5,000 represented 82% of all contemporary art transactions last year. Accessible works such as prints, photography, and limited editions are fueling this trend, allowing collectors to engage with the market without substantial financial risk. For instance, platforms like Artsy and smaller galleries have embraced this shift, enabling affordable acquisitions and increasing participation in art ownership.

Cryptocurrency is also reasserting its relevance, with high-profile purchases such as Maurizio Cattelan’s Comedian, selling for $6.2 million to crypto investors. The resurgence of digital currencies, coupled with pro-crypto policies from the incoming U.S. Treasury Secretary, signals the potential for further integration of blockchain technology into art transactions.

In 2025, new regulations are also looming, with the UK extending financial sanctions to art market participants. Businesses must now ensure compliance with stringent reporting and asset-freezing obligations, reflecting broader efforts to enhance transparency in luxury markets. Failure to comply could result in fines up to £1 million, adding administrative burdens to an already cautious market.

Looking ahead, the art market of 2025 is defined by contrasts: a resilient high-end sector supported by private sales, and growing accessibility for first-time buyers. While challenges persist, such as tightening regulations and geopolitical risks, the market demonstrates an adaptive spirit. This balance of stability and transformation positions 2025 as a pivotal year for redefining the art world’s reach and relevance.